It seems like the monetary policy is simply targeted at maintaining the exchange rate. But it’s a weak policy tool in terms of meeting the objective of exchange rate stability, as the Leone has continued to depreciate, driven by a number of factors – both external and internal. I am not sure I buy the Bank’s estimates of real GDP. If inflation is in the high teens, nominal GDP growth would need to be in the 20%s to get the estimated real GDP growth. It could be that the statement is confusing real GDP growth for nominal GDP growth. Nominal GDP growth of 3-4%, is quite weak for a country at the level of development like Sierra Leone.

Given that growth is stagnant and inflation is being driven by external shocks – high commodity prices, political uncertainty and supply side constraints – it seems crazy that the Bank is raising the policy rate at the same time as the government is adopting a contractionary fiscal stance. This is going to slow down growth even further. It’s not helpful reporting the current account balance and reserves the way they are reported in the Monetary Policy Report. A better way of reporting them is as a ratio of GDP or months of imports, rather than as monetary amounts. This gives a better indication of whether Sierra Leone’s external position is sustainable. It’s a good thing the government has set facilities to dampen the rising cost of fuel and food. This will help the poorest Sierra Leoneans adjust to the rising cost of living.

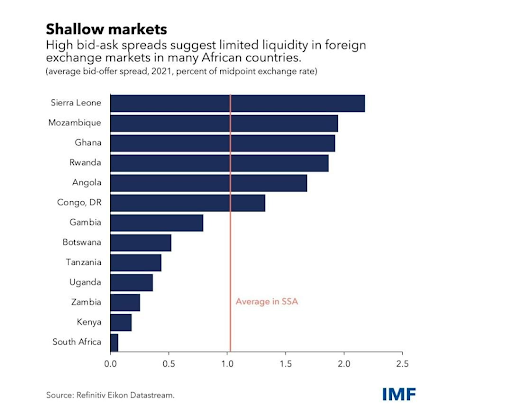

The other thing with the Monetary Policy Statement is that it says nothing about how exposed the banks in Sierra Leone are to currency mismatches, given the depreciation in the Leone. This is important for the BSL, in its role as the lender of last resort. The BSL should not just focus on reporting quarter on quarter growth trends, but should also report the annual growth trends and medium term trends in macro and monetary aggregates. These may carry more information than the short term changes. The BSL could do more to develop other policy tools besides the bank rate. With FX markets, the BSL could benefit from deepening those markets.